The QualityStocks Daily Stock List

- Quantum Computing, Inc. (QUBT)

- CynergisTek (CTEK)

- Better Therapeutics (BTTX)

- SciSparc Ltd (SPRC)

- Torrid Holdings (CURV)

- Revlon Inc. (REV)

- Charah Solutions (CHRA)

- Cementos Pacasmayo (CPAC)

- Avaya Holdings (AVYA)

- HIVE Blockchain Technologies Ltd. (HIVE)

- Gratomic Inc. (CBULF)

- Bit Digital Inc. (BTBT)

Quantum Computing, Inc. (QUBT)

QualityStocks, MarketClub Analysis, InvestorPlace, TradersPro and BUYINS.NET reported earlier on Quantum Computing, Inc. (QUBT), and today we highlight the Company, here at the QualityStocks Daily Newsletter.

Quantum Computing, Inc. is a technology company based in Leesburg Virginia. It focuses on developing novel applications and solutions utilizing quantum and quantum-inspired computing to solve difficult problems in various industries.

The Company has put together a world-class team of experts in supercomputing, technology, defense, and government. This team is working to develop solutions to world-class problems. It is developing processes to commercialize advances in quantum computing.

Quantum Computing is leveraging its collective expertise in finance, computing, security, mathematics, and physics to develop commercial applications for the financial and security sectors. It is developing a variety of software applications capable of running on quantum and quantum-inspired hardware from numerous vendors. The Company’s initial emphasis is on the creation of Quantum Finance applications.

Mukai is Quantum Computing’s proprietary middleware environment for developing applications to address complex optimization problems that are NP-hard, often involving multi-dimensional solution spaces with thousands if not hundreds of thousands of variables. The software stack contained in Mukai enables developers to create and deploy applications with superior performance on classical computers and future quantum computers.

Regarding Quantum Asset Allocator, Fund Managers can now use the Company’s quantum asset allocator to take advantage of quantum-inspired techniques to solve the NP-hard problems preventing them from truly optimal portfolio optimization. Concerning Community Detection, the Quantum Community Detector utilizes advanced graph analytics with quantum-inspired techniques to deliver insights into big data structures.

Quantum Computing, Inc. (QUBT), closed Tuesday’s trading session at $1.97, up 25.4777%, on 5,139,109 volume. The average volume for the last 3 months is 5.139M and the stock's 52-week low/high is $1.42/$10.43.

CynergisTek (CTEK)

MarketBeat, Zacks, StreetInsider and QualityStocks reported earlier on CynergisTek (CTEK), and today we highlight the Company, here at the QualityStocks Daily Newsletter.

CynergisTek Inc. (NYSE American: CTEK) is a cybersecurity and privacy consulting company that is engaged in the provision of privacy, cyber security and compliance services.

The firm has its headquarters in Austin, Texas and was incorporated in 1995. Prior to its name change in September 2017, the firm was known as Auxilio Inc. The firm serves consumers in the United States and derives most of its revenue from managed services.

The company has been a partner to hundreds of healthcare vendors, payers and providers since 2004 and is dedicated to supporting and educating the industry through its numerous contributions to associations like CHIME, IAPP, AHLA, HFMA and AHIMA. It mainly serves firms in highly regulated industries which include the healthcare industry, as well as the manufacturing, internet and media, government, financial services and education industries, under the Backbone Consulting, Redspin and CynergisTek brands.

The enterprise provides various solutions that assist in the development of best practice approaches to risk management and helps companies to measure privacy and security programs against regulatory requirements. Its services include validation, management, remediation, technical testing, audit and assessment services. The enterprise’s services are delivered mainly through its short-term professional and consulting service engagements or 3-year managed service agreements.

The firm recently expanded its partnership with Florida International University through a 3-year contract for its managed services. This will allow the firm to continue providing the solutions and expertise that meet its consumers’ needs, which may in addition to extending its consumer reach, have a positive effect on the firm’s growth.

CynergisTek (CTEK), closed Tuesday’s trading session at $1.18, up 100%, on 6,422,550 volume. The average volume for the last 3 months is 6.373M and the stock's 52-week low/high is $0.576757/$2.85.

Better Therapeutics (BTTX)

QualityStocks, Trades Of The Day, TradersPro, StocksEarning, MarketBeat and InvestorPlace reported earlier on Better Therapeutics (BTTX), and today we highlight the Company, here at the QualityStocks Daily Newsletter.

Better Therapeutics Inc. (NASDAQ: BTTX) is a biotechnology firm that is focused on the development of prescription digital therapeutics.

The firm has its headquarters in San Francisco, California and was incorporated in 2015. Prior to its name change, the firm was known as Mountain Crest Acquisition Corp II. The firm serves consumers around the globe.

The company builds prescription digital therapeutics which deliver a new kind of behavioral therapy and create feedback mechanisms through the use of patient-generated and remotely-monitored data. It has designed a proprietary platform which is used to develop software-based, FDA-regulated solutions for various conditions. The company validates its software via multiple clinical trials and commercializes it to private health insurance firms.

The enterprise develops treatments that reverse illness progression, improve quality of life of patients and inform clinical decisions. They include BT-001 and BT-002, which have been developed to treat uncontrolled type 2 diabetes; BT-003 which is indicated for the treatment of hypertension; and BT-004, which is used to treat hyperlipidemia. It also develops a new form of behavioral therapy known as nutritional cognitive behavioral therapy, which is indicated for the treatment of patients with cardiometabolic ailments like type 2 diabetes, stroke and non-alcoholic fatty liver disease.

The company recently appointed a new chief strategy officer who has decades of experience in using technology to transform healthcare. This decision will help the company achieve its objective to transform the treatment of cardiometabolic diseases, which will in turn be good for its growth and investments into the company.

Better Therapeutics (BTTX), closed Tuesday’s trading session at $2.19, up 69.7674%, on 40,627,006 volume. The average volume for the last 3 months is 39.928M and the stock's 52-week low/high is $0.912/$29.40.

SciSparc Ltd (SPRC)

Broad Street and QualityStocks reported earlier on SciSparc Ltd (SPRC), and today we highlight the Company, here at the QualityStocks Daily Newsletter.

SciSparc Ltd (NASDAQ: SPRC) is a specialty clinical-stage pharmaceutical firm that is focused on the development of drugs based on cannabinoid molecules.

The firm has its headquarters in Tel Aviv, Israel and was incorporated in 2004. Prior to its name change in January 2021, the firm was known as Therapix Biosciences Ltd. The firm serves consumers around the globe.

The company is party to an agreement with the Sheba Fund for Health Services and Research, which entails performing a pre-clinical trial evaluating the effectiveness of SCI-210 in the treatment of status epilepticus. It is also party to an agreement with Procaps, which entails the development and commercial manufacture of CannAmide in softgel capsule form and SCI-110. The company also has an agreement with The Israeli Medical Center for Alzheimer's, which involves carrying out a phase 2a clinical trial evaluating the effectiveness, tolerability and safety of SCI-110 in patients with Alzheimer’s disease.

The enterprise’s drug development programs include SCI-210, for the treatment of epilepsy and autism spectrum disorder; SCI-160 for the treatment of pain; and SCI-110, to treat obstructive sleep apnea and Tourette syndrome.

The firm recently partnered with Tel-Aviv Sourasky Medical School and Hannover Medical School to conduct clinical trials for its SCI-110 candidate. This move advances the firm’s efforts to create a viable therapeutic protocol for Tourette syndrome, which currently has no effective treatment. The success and approval of this candidate will not only benefit patients with this indication but also boost investments into the firm as well as its growth.

SciSparc Ltd (SPRC), closed Tuesday’s trading session at $2.8, up 42.8571%, on 15,420,890 volume. The average volume for the last 3 months is 15.421M and the stock's 52-week low/high is $0.0001/$8.50.

Torrid Holdings (CURV)

StocksEarning, Zacks, The Street and Schaeffer's reported earlier on Torrid Holdings (CURV), and today we highlight the Company, here at the QualityStocks Daily Newsletter.

Torrid Holdings Inc. (NYSE: CURV) is a holding firm that is engaged in the provision of apparel products.

The firm has its headquarters in City of Industry, California and was incorporated in 2015. It operates as part of the apparel retail industry, under the consumer cyclical sector. The firm has more than 3,000 companies in its corporate family and serves consumers around the globe, with a focus on those in the state of California.

The direct-to-consumer brand is focused on fit and provides high quality products across an extensive assortment that includes activewear, intimates, dresses, denim, bottoms, tops, footwear and accessories. It targets plus-sized women aged between 25 and 40. The company markets its products directly to consumers through its e-commerce platform.

The enterprise sells apparel products like sweaters, jackets, jeans, skirts, shorts, denims, intimates, gloves, belts, watches, handbags, swim wear, sleep wear and outerwear products, as well as non-apparel products which include footwear, accessories and beauty products. Its footwear products include sneakers and boots. The enterprise’s brands include Torrid Curve and Torrid. The Torrid Curve brand offers a line of bras, strapless bras, T-shirt bras and wire-free bras. It also offers a website and mobile app feature which offers updates on new collections, as well as guidance on how to wear and put together outfits.

The company’s recently announced financial results show increases in its revenues. It remains focused on extending its consumer reach through expansion in order to better meet consumer needs, which would be good for the company’s investments and revenues.

Torrid Holdings (CURV), closed Tuesday’s trading session at $4.9, off by 5.5877%, on 393,429 volume. The average volume for the last 3 months is 392,681 and the stock's 52-week low/high is $4.86/$33.19.

Revlon Inc. (REV)

Kiplinger Today, MarketBeat, The Street, StreetInsider, Trading Concepts, InvestorPlace, Stock Stars, MarketClub Analysis, SmarTrend Newsletters, Daily Wealth, Schaeffer's, Trades Of The Day, StreetAuthority Daily, Daily Trade Alert, Daily Profit, Stock Rich, TheStockAdvisors, HotOTC, CoolPennyStocks, FreeRealTime, InvestmentHouse, Investopedia, Coattail Investor, Dynamic Wealth Report, Market Intelligence Center Alert, Marketbeat.com, BUYINS.NET, SmallCap Network, Zacks, SmallCapVoice, Stock Tips Network, Stockhouse, The Growth Stock Wire, The Weekly Options Trader, TradersPro, Trading Markets and QualityStocks reported earlier on Revlon Inc. (REV), and today we highlight the Company, here at the QualityStocks Daily Newsletter.

Revlon Inc. (NYSE: REV) (LON: 0A7Z) (BMV: REV) (FRA: RVL1) is a beauty company that is focused on the development, manufacture, marketing, distribution and sale of beauty and personal care products.

The firm has its headquarters in New York and was incorporated in 1932. It operates as part of the household and personal products industry, under the consumer retail sector. The firm serves consumers around the globe.

The company operates through the portfolio and fragrances, Elizabeth Arden and Revlon segments. The portfolio and fragrances segment is focused on marketing and distributing the company’s products to professional salon, hair and nail salon and retail channel distributors in the United States as well as internationally. The Elizabeth Arden segment is comprised of e-commerce sites, department and specialty stores, boutiques, perfumeries, retail channels, prestige retailers, travel retailers and distributors as well as direct sales to consumers through Elizabeth Arden e-commerce websites and branded retail stores. On the other hand, the Revlon segment develops products which are marketed, distributed and sold in department stores, e-commerce sites, general merchandise stores, large volume retailers, retail channels, chain drug and food stores, beauty retailers and cosmetic stores and professional nail and hair salons. The company generates the majority of its revenue from the Revlon segment. Its products include fragrances, anti-perspirant deodorants, men’s grooming products, beauty tools, hair care, color and treatments and cosmetics, among others.

The enterprise recently reported its latest financial results, with its CEO noting that they remained focused on executing the company’s strategic plan for digital acceleration, which would drive sustainable long-term growth.

Revlon Inc. (REV), closed Tuesday’s trading session at $3.64, off by 8.3123%, on 224,717 volume. The average volume for the last 3 months is 222,148 and the stock's 52-week low/high is $3.61/$17.65.

Charah Solutions (CHRA)

MarketBeat, StockMarketWatch, MarketClub Analysis, Trades Of The Day, StreetInsider, StocksEarning, Daily Trade Alert and BUYINS.NET reported earlier on Charah Solutions (CHRA), and today we highlight the Company, here at the QualityStocks Daily Newsletter.

Charah Solutions Inc. (NYSE: CHRA) (FRA: 7AR) is a holding firm that is engaged in the provision of environmental services to the power generation industry.

The firm has its headquarters in Louisville, Kentucky and was incorporated in 2018, on January 30th by Charles E. Price. It operates as part of the waste treatment and disposal industry, under the industrials industry. The firm has twenty-four companies in its corporate family and serves consumers in the United States.

The company operates through the Maintenance and technical services segment and the Environmental solutions segment. The technical services segment is comprised of nuclear services and fossil services. On the other hand, the environmental segment is focused on remediation and compliance services, which include management of existing and new ash ponds and landfills for coal-fired power generating facilities

The enterprise’s remediation and compliance services also include construction of landfill and cap and cover systems, design engineering, permit application and processing for greenfield sites and expansions, hydrogeological assessment, site evaluation and characterization, and, landfill construction and management. It also recycles contracted and recurring volumes of byproducts of coal-fired power generation waste, which include fly ash, bottom ash and gypsum byproducts for use in a range of industrial purposes. This is in addition to providing coal ash management services.

The firm, which recently announced its latest financial results, is currently focused on growing its business. This will not only help extend its consumer reach and bring in additional revenue but also encourage more investments into the firm and help create shareholder value.

Charah Solutions (CHRA), closed Tuesday’s trading session at $2.51, up 2.449%, on 90,413 volume. The average volume for the last 3 months is 90,413 and the stock's 52-week low/high is $2.205/$6.63.

Cementos Pacasmayo (CPAC)

The Online Investor, MarketBeat, Zacks, Trades Of The Day, Marketbeat.com, Daily Trade Alert and StreetInsider reported earlier on Cementos Pacasmayo (CPAC), and today we highlight the Company, here at the QualityStocks Daily Newsletter.

Cementos Pacasmayo S.A.A. (NASDAQ: CPAC) (FRA: EPCC) is a cement firm that is focused on producing, marketing and distributing cement and cement-related materials like ready-mix concrete and quicklime.

The firm has its headquarters in Lima, Peru and was incorporated in 1949. Prior to its name change, the firm was known as Pacasmayo Cement Corp. It operates as part of the building materials industry, under the basic materials sector. The firm serves consumers around the globe.

The company operates through the Sales of construction supplies; Quicklime; and the Cement, concrete and Precast segments. It operates as a subsidiary of Inversiones ASPI S.A.

The enterprise is involved in the production of cement for different uses, such as ready-mix concrete used at construction sites; commercial and residential construction and civil engineering; concrete precast such as paver stones or paving units for pedestrian walkways, as well as other bricks for concrete precast and partition walls for non-structural and structural uses; and cement-based products. It is also involved in the production and distribution of quicklime for use in agriculture, mining, chemical fishing, food, steel and other industries. In addition to this, the enterprise is involved in the sale and distribution of construction materials like pipes, steel rebars and cables. As of March 2022, the enterprise operates a network of almost 380 hardware stores and more than 200 independent retailers.

The firm is focused on increasing its revenues, sales volume of cement, precast and concrete and becoming more sustainable. This will encourage more investments into the firm and help create shareholder value.

Cementos Pacasmayo (CPAC), closed Tuesday’s trading session at $5.2699, off by 0.941729%, on 4,269 volume. The average volume for the last 3 months is 4,269 and the stock's 52-week low/high is $5.05/$8.30.

Avaya Holdings (AVYA)

MarketBeat, Schaeffer's, MarketClub Analysis, StreetInsider, Kiplinger Today, The Street, StockMarketWatch, Trading Concepts, Trades Of The Day, Zacks, InvestorPlace, CNBC Breaking News, AllPennyStocks, Daily Trade Alert, BUYINS.NET and QualityStocks reported earlier on Avaya Holdings (AVYA), and today we highlight the Company, here at the QualityStocks Daily Newsletter.

Avaya Holdings Corp. (NYSE: AVYA) (FRA: 1KU) is a holding firm that is engaged in the provision of digital communications services, solutions and products.

The firm has its headquarters in Durham, North Carolina and was incorporated in 2007, on June 1st. It operates as part of the software-application industry, under the technology sector. The firm has more than three hundred companies in its corporate family and serves consumers around the globe.

The company operates through the services segment and the products and solutions segment. The services segment is focused on the development, marketing and sale of end-to-end service offerings which allow consumers to evaluate, plan, develop, implement, monitor, optimize and manage complex communication networks. On the other hand, the products and solutions segment is focused on the development, marketing and sale of unified communications, contact center and collaboration solutions which are provided as hybrid solutions in the cloud or on-premises. These solutions integrate multiple communications forms, including video, instant messaging, email and telephony.

The enterprise’s solutions include its OneCloud UCaaS solution which allows an organization to provide its workers with one application for all-channel messaging and calling. It also offers OneCloud CCaaS solutions which allow consumers to build a customized application portfolio to drive customer engagement and customer value.

The firm recently entered into a strategic partnership with Microsoft, which will not only open it up to new growth opportunities and help extend its consumer reach but also bring in additional revenues into the firm and bolster its growth.

Avaya Holdings (AVYA), closed Tuesday’s trading session at $3.22, off by 21.6545%, on 6,812,809 volume. The average volume for the last 3 months is 6.808M and the stock's 52-week low/high is $3.12/$29.55.

HIVE Blockchain Technologies Ltd. (HIVE)

InvestorPlace, MarketClub Analysis, MarketBeat, QualityStocks, StreetInsider, StockMarketWatch, Marketbeat.com, Greenbackers, Hit and Run Candle Sticks, Barchart, Stock Market Watch, WealthMakers, StockOodles, StreetAuthority Daily, TopStockAnalysts, Wall Street Resources and smartOTC reported earlier on HIVE Blockchain Technologies Ltd. (HIVE), and today we highlight the Company, here at the QualityStocks Daily Newsletter.

HIVE Blockchain Technologies (NASDAQ: HIVE) (TSX.V: HIVE) (FSE: HBF) today announced that, further to its May 10 press release, the company will be proceeding with the consolidation of its common shares on the basis of five pre-consolidation common shares for one post-consolidation common share. The common shares will commence trading on the TSX Venture Exchange (“TSXV”) and Nasdaq on a post-consolidation basis effective at the opening of the market on May 24, 2022. Completion of the consolidation is subject to receipt of all necessary regulatory approvals, including TSXV approval and pursuant to the Business Corporations Act (British Columbia) and the articles of the company. “HIVE has accomplished an incredible amount over the past few years. Today we’re one of the most profitable and fastest-growing crypto miners in the world,” said Frank Holmes, executive chairman of HIVE. “Despite our record profitability, HIVE shares trade at around a 2.2 P/E ratio as of May 23, 2022. This share consolidation will allow us to remove some of the penny stock stigma and allow us to engage more institutional investors.”

To view the full press release, visit https://ibn.fm/D9xvD

About HIVE Blockchain Technologies Ltd.

HIVE Blockchain Technologies went public in 2017 as the first cryptocurrency mining company with a green energy and ESG strategy. The company mines Bitcoin and Ethereum using primarily clean, cheap hydroelectric power in Canada, Sweden and Iceland. HIVE is a growth-oriented technology stock in the emergent blockchain industry. It is building a bridge between the digital currency and blockchain sector and traditional capital markets. HIVE owns state-of-the-art, green energy-powered data center facilities in Canada, Sweden and Iceland, where it sources only green energy to mine on the cloud and HODL both Ethereum and Bitcoin. Since the beginning of 2021, HIVE has held in secure storage the majority of its ETH and BTC coin mining rewards. HIVE shares provide investors with exposure to the operating margins of digital currency mining, as well as a portfolio of cryptocurrencies such as ETH and BTC. Because HIVE also owns hard assets such as data centers and advanced multi-use servers, the company believes its shares offer investors an attractive way to gain exposure to the cryptocurrency space. For more information and to register to HIVE’s mailing list, please visit www.HIVEBlockchain.com.

HIVE Blockchain Technologies Ltd. (HIVE), closed Tuesday’s trading session at $3.82, off by 10.12%, on 1,929,126 volume. The average volume for the last 3 months is 1.929M and the stock's 52-week low/high is $3.74/$28.00.

Gratomic Inc. (CBULF)

QualityStocks and equities Canada reported earlier on Gratomic Inc. (CBULF), and today we highlight the Company, here at the QualityStocks Daily Newsletter.

Gratomic (TSX.V: GRAT) (OTCQX: CBULF) (FSE: CB82), a multinational company focused on becoming a leading global graphite supplier, today announced an update on the planned 1,250 m Diamond Drill (“DD”) campaign currently underway at its Aukam Project in Namibia. According to the update, the drillholes are planned to intersect mineralization below the current mine adits. AKD001, the first of 2022, is a twin hole of AKR026, which was drilled towards the end of 2021. AKD001 has intercepted vein graphite mineralization approximately 40 m below the main adit. Results are not true thicknesses and will be calculated and verified during detailed core logging.

To view the full press release, visit https://ibn.fm/ZW8u0

About Gratomic Inc.

Gratomic is a multinational company with projects in Namibia, Brazil and Canada. The company is focused on becoming a leading global graphite supplier and aims to secure a strong position in the EV battery supply chain. With the continued development of its flagship Aukam project and further exploration on the company's Capim Grosso property, Gratomic sets itself apart by seeking out unique top-quality assets around the world. True to its roots, the company will continue to explore graphite opportunities displaying potential for development. The company ranked third place in the top 10 preforming mining stocks on the 2022 TSX Venture 50(TM). Large quantities of high-quality vein graphite have been shipped for testing to confirm its viability as an anode material. Gratomic is confident that the test results will provide a unique competitive advantage in its desired target markets. The company will continue to update the public on the status of these tests and will provide results as soon as they become available. The company has formed a collaboration agreement with Forge Nano. With its patented ALD coating, this cooperation with Forge Nano is a key element to support Gratomic’s strategies towards the value-added phases of production of graphite for anode applications, namely micronization, spheronization and coating, making Gratomic graphite a preferred choice for use in lithium-ion batteries. For more information about the company, visit www.Gratomic.ca.

Gratomic Inc. (CBULF), closed Tuesday’s trading session at $0.375, off by 3.7227%, on 52,772 volume. The average volume for the last 3 months is 52,772 and the stock's 52-week low/high is $0.2995/$1.40.

Bit Digital Inc. (BTBT)

MarketClub Analysis, Schaeffer's, QualityStocks, StocksEarning, TradersPro, MarketBeat, InvestorPlace and Daily Trade Alert reported earlier on Bit Digital Inc. (BTBT), and today we highlight the Company, here at the QualityStocks Daily Newsletter.

- The blockchain technology industry is projected to grow to $450 billion by 2028, up from $3.67 billion in 2020, representing a CAGR of 82.4%

- The cryptocurrency market, which was valued at $1.5 billion in 2021, is projected to grow to $2.3 billion by 2028, representing a CAGR of 6.9%

- Bit Digital looks to tap into these two markets through strategic investments and technology

- The company is confident that the value of cryptocurrency will continue to rise, despite the recent drastic price fluctuations

Over the past few weeks, the price of many cryptocurrencies have reduced by more than 50%. Industry experts have cited a sell-off in the global stock market as the main reason for this decline. The two largest cryptocurrencies fared better than the average with Bitcoin posting a 24.69% regression and Ethereum posting a 31.7% decline (https://ccw.fm/adYwu).

In 2021, Bitcoin did quite well with a 70% gain prior to the close of the calendar year. On the other hand, 2022 has seen a shift to more value-based investments instead of speculative stocks and alternative “store of value” investments (https://ccw.fm/Z8VwS).

One company, however, which maintains that there is still value and potential for growth in cryptocurrency, more specifically Bitcoin and Ethereum, is Bit Digital (NASDAQ: BTBT). Founded in 2017 and commencing Bitcoin mining in February 2020, this company recognizes the value in cryptocurrency and is at the forefront of pushing the conversation forward and redefining crypto mining.

In addition to crypto mining, Bit Digital is also a key player in the blockchain technology sector. This market was valued at $3.67 billion in 2020, estimated to grow to $450 billion by 2028, representing a CAGR of 82.4%. With the growing adoption of blockchain technology by commercial and central banks globally for payment processing and issuance of their digital currencies, Bit Digital is well-positioned to capitalize on this opportunity to grow its market share and create value for its shareholders (https://ccw.fm/0s7pw).

Cryptocurrency is gaining worldwide acceptance, a factor shaping the market’s growth. It is projected that by 2028, the cryptocurrency market will be valued at over $2.3 billion, up from $1.5 billion in 2021. This represents a CAGR of 6.9% over the forecast period. This potential growth is an opportunity that Bit Digital looks to tap into, as evidenced by its investment in infrastructure and partnerships in North America (https://ccw.fm/jue3V).

As of January 2022, only 18.9 million bitcoins were issued, leaving about 2.1 million yet to be mined. Bit Digital’s investment in the mining business hopes to tap into the cryptocurrency’s potential for growth and the opportunity to mine what is left of the yet-to-be-issued coins (https://ccw.fm/wIXp9). After all the coins are mined, miners are expected to receive compensation solely through transaction fees.

Cryptocurrencies might have been in the news recently for their volatility, having previously been considered a reliable asset during economic uncertainty. However, with over 2 million coins yet to be released, crypto mining is proving to have tremendous value. For Bit Digital, its investment in miners on the spot market and application-specific integrated circuit (“ASIC”) chips allow for greater and faster output, resulting in increased returns for the company.

Bit Digital is illustrative of the opportunity that exists in the cryptocurrency market. With over 27,000 miners as of September 30, 2021, the company is confident that it has what it takes to take on the industry and become the undisputed leader.

For company information, visit the company’s website at www.Bit-Digital.com.

Bit Digital Inc. (BTBT), closed Tuesday’s trading session at $1.48, off by 8.642%, on 1,798,784 volume. The average volume for the last 3 months is 1.799M and the stock's 52-week low/high is $1.38/$20.74.

The QualityStocks Company Corner

- Tingo Inc. (OTC: TMNA)

- FuelPositive Corp. (TSX.V: NHHH) (OTC: NHHHF)

- LQwD FinTech Corp. (TSX.V: LQWD) (OTCQB: LQWDF)

- EverGen Infrastructure Corp. (TSX.V: EVGN) (OTCQB: EVGIF)

- Nowigence Inc.

- SRAX Inc. (NASDAQ: SRAX)

- Knightscope Inc. (NASDAQ: KSCP)

- Lexaria Bioscience Corp. (NASDAQ: LEXX)

- Pressure BioSciences Inc. (PBIO)

- Cybin Inc. (NEO: CYBN) (NYSE American: CYBN)

- CNS Pharmaceuticals Inc. (NASDAQ: CNSP)

- Cannabis Strategic Ventures Inc. (OTC: NUGS)

Tingo Inc. (OTCQB: TMNA)

The QualityStocks Daily Newsletter would like to spotlight Tingo Inc. (TMNA).

Human beings have always been attracted by the possibility of making a quick buck, and the volatility of cryptocurrencies and NFTs is too alluring for members of Generation Z. Gen Z refers to individuals born in the mid ‘90s to the early 2000s. As the years in which these people were born suggest, Gen Z grew up at a time when the proliferation of technology was at its peak. This means that these kids grew up playing video games and meeting their friends virtually. It seems natural, therefore, that they would take to crytocurrency and NFT trading in a big way since tech and gadgets are their thing. Given that cryptocurrency trading attracts such strong emotions from both believers and detractors, the efforts being made to regulate the industry in different jurisdictions can only be welcomed since they will create a level playing field for all concerned. Such regulations could end up boosting the early movers in the blockchain space, such as Tingo Inc. (OTC: TMNA), that are developing novel platforms to address longstanding societal problems on various continents, including Africa.

Tingo Inc. (OTCQB: TMNA) is a digital service agri-fintech technology company focused on foundation-level agriculture and related financial services in Africa. The company aims to be Africa’s leading agri-fintech player, transforming rural farming communities to connect through its proprietary platform to meet their complete needs – from inputs and agronomy to off take and marketplace – and deliver sustainable income in an impactful way. The company’s vision is to build complete digitally inclusive ecosystems that promote financial inclusion and deliver disruptive micro-finance solutions, empower societies, produce social upliftment in rural communities and open international opportunities.

Tingo believes that a truly connected world will help contribute to a better global society. The company’s core focus areas are telecoms, financial services/fintech and agritech. Tingo’s goal is to provide a best-in-class customer experience, support the domestic economies of its host countries and support technological and financial inclusion to end the poverty premium. Through this, Tingo hopes to deliver attractive returns to shareholders while investing in the long-term future of the company and its subsidiaries.

Global climate change is challenging sustainable production and food security. Tingo’s strategy and market execution provide an opportunity for Africa to be a core focal point to solve a number of key areas of concern, including food security, gender equality, financial inclusion and poverty alleviation, to name a few. Disruption of micro finance through the use of DeFi-based stable coins and smart contracts will give agri-communities access to capital markets-driven digital finance solutions that make them more competitive and sustainable economically, striking a good balance of returns between digital asset providers and Tingo as the service partner. This innovation will deliver significant access to much needed finance at ‘Grassroot’ levels, delivering tangible social upliftment and GDP growth in the African markets served by Tingo.

Tingo Mobile, with more than nine million subscribers, is Nigeria’s leading technology and device-as-a-service platform aimed at accelerating digital commerce, especially in the country’s agritech and fintech verticals. The company helps farmers acquire mobile phones through a unique leasing plan, connecting them to mobile and data networks through its own virtual mobile network. Tingo also connects farmers to markets, services and resources via Nwassa, its digital agritech marketplace platform that commenced operations in 2020. The company has also launched a beta version of TingoPay – a B2B and B2C fintech app aimed at providing financial services to users inside and outside of the agriculture value chain. Among the services offered are mobile wallets, payment processing and access to specialist lenders, insurers and pension products.

Tingo will soon announce its innovative blockchain-based solution for use of digital stable coins to empower frictionless trade across borders in Africa. The company’s market-proven model in Nigeria is its core foundation, enabling Tingo to deliver the same service model across Africa to become the continent’s leading agri-fintech business powered through smartphone technology.

The African Continental Free Trade (ACFT) plan will be a key framework to prepare the company to be the leading intra-Africa trading hub for trade flows across Africa in the medium term, when it is likely the agreement will be executed into tangible activity. Tingo is well positioned to easily transform the goals of the ACFT into reality when finally implemented by the African Union and the various African countries that have not signed up.

Tingo posted total revenue of $594 million in 2020, with $212 million EBITDA. As of December 31, 2020, Tingo has 9,344,000 subscribers. The company is confident that these figures will grow through its expansion across Africa and natural progression of business in Nigeria.

Businesses

Tingo has four core businesses:

- Mobile Phone Leasing – Tingo has distributed almost 30 million mobile handsets since 2014 and will continue to replace the devices of its installed customer base every three years. Tingo Mobile provides the latest mobile phone handsets at an affordable price point and allows customers to spread payments over 36 months.

- Mobile Voice and Data Service – Through a mobile virtual network, Tingo provides its customers with voice and data services, allowing customers to communicate effectively, both inside and outside the agricultural ecosystem.

- Nwassa Marketplace Platform – Nwassa is Tingo’s proprietary agritech platform which provides Africa’s farmers with access to global markets to secure more competitive pricing for their crops. The platform processes 500,000 daily transactions with a value of over $8 million. A select group of trusted partners can assist smallholder farmers and agricultural cooperatives with packaging, warehousing, and dry and wet cargo logistics, as well as up-to-date information from the global agricultural sector. Tingo provides its customers with digital wallet services, which enable them to send and receive domestic payments, monitor cash flow in real time and securely hold money. The company also provides access to other services, such as utility bill payment, virtual airtime top-up, insurance services and alternative lending solutions.

- TingoPay – Since the launch of the Nwassa platform, Tingo has been a dominant player in the B2B fintech vertical. After many successful months of operating Nwassa, Tingo entered the fintech B2C vertical to extend its B2B offering to a broader market beyond agriculture.

TingoPay is still in its beta phase and will launch in 2021 with a comprehensive marketing campaign. TingoPay offers the following services:

- Tingo Wallet top-up

- Peer to Peer payments, inclusive of merchant payments at the stores

- Utility payments – airtime, broadband, cable, electricity, water, hotel, flights etc.

- Pension payments

- QR code payment services

Market Opportunity

Africa is the second-largest continent by population. It is also the youngest by far, with a median age of 18 for its 1.3 billion people. Tingo believes the building blocks for growth in Africa’s agriculture industry are in place and that the company is well positioned to participate in the upside. Sub-Saharan Africa’s population is growing at a rate of 2.7 percent per year. At the current growth rate, the continent’s population will double by 2050. Africa’s youthfulness represents a significant opportunity for material growth in demand for agricultural commodities. This younger generation is also being born into a digital world and is comfortable using technology.

Africa’s governments are improving business conditions for entrepreneurs and small businesses. Sub-Saharan Africa’s World Bank Doing Business rank has improved from 45 in 2004 to 65 in 2020. Tingo believes this trend will continue and encourage establishment of more new ventures across all economic sectors, including agriculture.

Africa attracted $407 billion of Foreign Direct Investments (“FDI”) between 2014 and 2018. Investments are increasingly focused on services and industrial sectors. Only 20 percent of investments are in extractive industries – a clear reversal from 2008, when 55 percent of FDI was aimed at resource extraction. Tingo believes FDI into Africa will help resolve significant infrastructure constraints and create value for agribusiness.

Management Team

Dozy Mmobuosi is the CEO of Tingo. He cofounded Tingo Mobile PLC (Nigeria) in 2001 and led the design and launch of Nigeria’s first SMS banking solution, which is still in use in the country today. He also headed a team of more than 120 Chinese and Nigerian engineers in the construction of two mobile phone assembly plants in Nigeria, which have produced and distributed 20 million phones across the country. He has led Tingo’s growth to more than $600 million in revenue annually. He holds a Ph.D. in Rural Advancement from UPM Malaysia.

Dakshesh Patel is the CFO of Tingo. He was formerly CFO of NatWest’s Global Debt and Investment Banking division. He has served as a Director at Gerken Capital Associates, a San Francisco-based alternative asset fund manager. He also led the restructure of Lloyds Banking Group (last financial crisis); managed integration of two leading shipping groups’ global treasury function to create world-leading shipping group Maersk Shipping; built three fintech companies; and exited one to Worldpay. Mr. Patel has strong banking experience, with a focus on Africa. He is a chartered accountant.

Chris Cleverly is president of Tingo. He has served as CEO of the Made in Africa Foundation, and as CEO of blockchain payments gateway startup Kamari. He has been a board member of several companies, both public and private, in the UK, India, China and Africa. He has advised multiple UK companies on their entrance into African markets, and regularly advises the UK Government on development issues and African governments on investment issues.

Clarence Simms is the Chief Technology Officer at Tingo. He has 25 years of IT and IT management experience. He has worked in IT Shared Services Technical Operations and IT Program Management for Huawei Technologies and MTN. As an entrepreneur, he created Africaprepay.com, a service that allows African Diaspora travelers to send airtime, pay bills, send mobile money and transfer money to a bank account from anyplace in the world.

Rory Bowen is the Chief of Staff at Tingo. Mr. Bowen started his career in traditional capital and derivatives markets working for Moneycorp and Tradition UK in European and emerging markets across FX, interest rate derivative and government bond markets. He has also spent time with one of Europe’s fastest growing fintech’s banking circles. Before joining Tingo, he was Chief of Staff at FinTech Alliance, an organization established in partnership with the UK Government Department for International Trade to foster innovation, growth and foreign direct investment (FDI) in the financial services sector and facilitate greater public/private cooperation.

Tingo Inc. (OTCQB: TMNA), closed Tuesday’s trading session at $1.5, up 7.1429%, on 15,651 volume. The average volume for the last 3 months is 15,651 and the stock's 52-week low/high is $0.75/$8.98.

Recent News

- Tingo Inc. (OTC: TMNA) - How Gen Zers Are Hooked on NFTs and Cryptocurrencies

- InvestorNewsBreaks - Tingo Inc. (TMNA) Announces Q1 2022 Financial Results

- InvestorNewsBreaks - Tingo Inc. (TMNA), MICT Inc. (NASDAQ: MICT) Enter Definitive Merger Agreement

FuelPositive Corp. (TSX.V: NHHH) (OTC: NHHHF)

The QualityStocks Daily Newsletter would like to spotlight FuelPositive Corp. (NHHHF).

- FuelPositive is a technology company focused on developing clean energy solutions such as a green ammonia production system, its flagship product

- The company recently held its AGM, in which management discussed the milestones achieved in 2021 and the plans for 2022 and beyond

- According to FuelPositive, the first demonstration unit of its green ammonia production system is on track to be “farm-ready” by late summer 2022, although some issues outside its control may cause a delay in operationalization/commissioning at the farm level

- Management also updated shareholders on the remote monitoring capability of the system, carbon credits as a result of the emission reductions, and more

On April 19, FuelPositive (TSX.V: NHHH) (OTCQB: NHHHF), a company focused on developing clean energy solutions, held its virtual Annual General Meeting (“AGM”) in which the management, as well as Dr. Ibrahim Dincer – the lead inventor of the company’s flagship green ammonia production system, and Curtis Hiebert – FuelPositive’s first demonstration project partner, addressed shareholders, investors, and the general public. The management team also fielded questions (https://ibn.fm/lg1Zo).

FuelPositive Corp. (TSX.V: NHHH) (OTC: NHHHF) is a growth stage company focused on licensing, partnership and acquisition opportunities building upon various technological achievements. The company is committed to providing commercially viable and sustainable clean energy solutions, including carbon-free ammonia (NH3), for use across a broad spectrum of industries and applications.

FuelPositive is headquartered in Toronto, Canada.

Hydrogen Economy Problems and FuelPositive’s Carbon-Free Technology

The hydrogen economy is currently facing many challenges. Traditional NH3 manufacturing exists on a massive scale, but centralized facilities result in some of the world’s most concentrated CO2 emissions. In total, an estimated 200 million metric tonnes of NH3 are consumed each year, with greater than 80% utilized by the agricultural sector. NH3 is also being positioned as a viable alternative to fossil fuels.

FuelPositive’s flagship carbon-free ammonia technology provides an innovative solution to these environmental concerns. Developed by Dr. Ibrahim Dincer and his team, the company’s platform allows for the in-situ production of NH3 in an entirely sustainable manner, using only water, air and sustainable electricity.

The production of hydrogen is energy intensive, but it is just one variable hindering the growth of the hydrogen economy. Other hurdles include:

- Storage – The storage of hydrogen by compression or liquification are both cost prohibitive and unsustainable.

- Distribution – The distribution network for effective hydrogen deployment has yet to be developed, as the extreme high-pressure distribution requirements to transport hydrogen would result in enormous infrastructure costs.

- End Use – R&D on the transportation-related end use applications for hydrogen is in its infancy, but almost any vehicle on the road today can be easily converted to run on NH3 at a considerably lower cost per mile traveled when compared to traditional fossil fuels.

A key benefit of FuelPositive’s patent-pending, first-of-its-kind carbon-free NH3 technology is its flexibility. The process allows for small, medium or large-scale production of NH3 on location, minimizing or even eliminating the challenges and volatility associated with storage and transportation to end use. As such, with an appropriately sized FuelPositive system and access to renewable energy, the end use applications for the company’s platform are nearly infinite.

Manufacturing Partnership

On May 19, 2021, FuelPositive announced its selection of National Compressed Air Canada Ltd. (“NCA”) to undertake manufacturing of the company’s Phase 2 hydrogen-ammonia synthesizer commercial prototype systems for carbon-free ammonia production.

In a news release detailing the partnership, FuelPositive CEO Ian Clifford noted, “This critical milestone for FuelPositive will confirm the broad application potential for our technology and is the backbone of our Carbon-Free Hydrogen-NH3 offering. Partnering with the knowledgeable and experienced team at NCA on this commercialization project will bring our development-stage program to life.”

Global Ammonia Market Outlook

The global ammonia market was valued at $52.71 billion in 2017 and is forecast to reach $81.42 billion by 2025, growing at a CAGR of 5.59%, according to data from Fior Markets (https://ibn.fm/1OfOB).

The agricultural industry consumes more than 80% of global NH3. Smaller percentages can be attributed to the waste, water treatment, refrigerants, antiseptic, textile, mining and pharmaceutical industries.

One of the most polluting industries on the planet consists of conventional agribusinesses. These polluters are responsible for more greenhouse emissions per year than transportation. This is where FuelPositive’s technology is expected to be extremely beneficial.

Management Team

Ian Clifford is Director, CEO and Founder of FuelPositive Corp. He has over 25 years of experience in the fields of technology and marketing and has successfully led the company to global brand recognition through its unique energy solutions. Since 2006, Mr. Clifford has raised over $50 million in equity financing for FuelPositive. He also co-founded digIT Interactive, a full-service internet marketing company serving Fortune 500 clients, which he sold at the peak of the market in 2000.

Greg Gooch serves as a Director and President of FuelPositive. His multifaceted career in the electronics and finance industries has positioned him as a key advisor and funding partner to start-ups and new technology companies for over 40 years. Mr. Gooch has been involved with FuelPositive since its early days and has remained a significant supporter and consultant to the company over the years. He has a bachelor’s from McGill University and an MBA from the University of Western Ontario.

Dr. Ibrahim Dincer is a scientific advisor to FuelPositive and is recognized as a pioneer and international leader in the area of sustainable energy technologies. Along with his team, Dr. Dincer invented the modular carbon-free ammonia (NH3) production technology that FuelPositive is commercializing. His area of specialty covers various topics including ammonia, hydrogen energy and fuel cells; renewable energy systems; energy storage systems and applications; carbon capturing technologies, and integrated and hybrid energy systems He is currently managing an exemplary team of researchers in this commercialization project.

Marek Warunkiewicz is the company’s Communications & Branding Specialist. He brings more than 40 years of entrepreneurial expertise to the FuelPositive team, having held marketing, branding, advertising, project management and graphic design positions with various companies. Mr. Warunkiewicz has successfully created business-to-business marketing and advertising campaigns for a diverse group of clients ranging from high-tech to agriculture. He co-founded digIT Interactive and ZENN Motor Company alongside Ian Clifford.

Luna Clifford is the Director of Communications for FuelPositive. She has over 10 years of experience as a business owner and advisor, helping build and operate several successful start-up enterprises while managing complex stakeholder relationships. Ms. Clifford excels in strategic planning and team building, and she has completed extensive studies in the fields of communications and health care.

FuelPositive Corp. (NHHHF), closed Tuesday’s trading session at $0.13275, up 6.2%, on 129,263 volume. The average volume for the last 3 months is 129,263 and the stock's 52-week low/high is $0.09/$0.31.

Recent News

- FuelPositive Corp. (TSX.V: NHHH) (OTC: NHHHF) - FuelPositive Corp.'s (TSX.V: NHHH) (OTCQB: NHHHF) Management Shares 2021 Progress, Discusses 2022 Milestones in a Recent Virtual Annual Generation Meeting

- FuelPositive Corp. (TSX.V: NHHH) (OTCQB: NHHHF) Announces First Demonstration Project Partner to Showcase its Full-Sized Green Ammonia Production System

- GreenEnergyBreaks - FuelPositive Corporation (TSX.V: NHHH) (OTCQB: NHHHF) Engaging Directly with Farmers in Design of 'Plant-in-a-Box' System

LQwD FinTech Corp. (TSX.V: LQWD) (OTCQB: LQWDF)

The QualityStocks Daily Newsletter would like to spotlight LQwD FinTech Corp. (TSX.V: LQWD) (OTCQB: LQWDF).

- The Lightning Network is being incorporated by more companies, including the likes of Meta, which is currently striving to develop its own stablecoin offering but is receiving backlash from the government

- CoinCorner has released the first contactless payment card for the Lightning Network; the card works like Visa and other fiat currency cards but utilizes Bitcoin and the Lightning Network for fast and low fee transactions

- LQwD has ten nodes on the Lightning Network, each growing in BTC capacity and value – the company anticipates continuing to strive toward scalability of BTC

The Bitcoin Lightning Network, a layer 2 payment protocol layered on blockchain-based cryptocurrencies that enable lightning-fast transactions and lower fees, is making headlines. One company, CoinCorner, has announced the launch of the first Bitcoin contactless payment card, powered by near-field communication (“NFC”) and the Lightning Network. “Making in-person payments with Bitcoin and Lightning is still not as efficient and user-friendly as we need it to be for the mass audience. It still involves unlocking a phone, opening an app, scanning a QR code, and then making the transaction,” CoinCorner CEO Danny Scott explained the reason behind the creation of The Bolt Card (https://ccw.fm/ZwpNF). “This is a backwards step when it comes to user experience in comparison to what we're used to today for in-person payments.” LQwD FinTech (TSX.V: LQWD) (OTCQB: LQWDF), a financial technology company focused on the creation of enterprise-grade infrastructure driving the adoption of Bitcoin, has launched several nodes on the Lightning Network using its own Bitcoin as operational assets. The company launched its platform as a service (“PaaS”) offering in November 2021 and began operating its first Lightning Network node in the U.S. around the same time.

LQwD FinTech Corp. (TSX.V: LQWD) (OTCQB: LQWDF) is a financial technology company focused on creating enterprise-grade infrastructure to drive bitcoin adoption.

LQwD FinTech’s mission is to develop institutional-grade services that support the Lightning Network and drive improved functionality, transaction capability, user adoption and utility, and scaling of bitcoin. LQwD is also securing a substantial position in bitcoin as an operating asset and will use its holdings to establish nodes and payment channels on the Lightning Network.

The Lightning Network is a second-layer protocol, sitting above the bitcoin blockchain, intended to facilitate faster micro-transactions and lower fees on bitcoin transactions, thus allowing mass adoption of bitcoin.

LQwD expects the Lightning Network to eclipse the patchwork of legacy financial networks that are used to move value today. The company’s software will make migration from legacy networks onto the Lightning Network easy and seamless. By onboarding more financial service providers, LQwD intends to grow the value of the Lightning Network.

The company, formerly known as Interlapse Technologies Corp., is harnessing new payment rails built on top of the bitcoin blockchain that are capable of beyond visa-level transaction volumes and backed by bitcoin, the strongest and most well-known cryptocurrency. These new rails, enabled by the Bitcoin Lightning Network, open a vast opportunity and market segment for digital payments and financial services on a global scale. LQwD aims to leverage its position as a public company to enhance trust in its products and services, and leverage its shares as currency for acquisitions, roll-up and growth, as well as to attract and retain top industry talent.

Product

The Lightning Network is a solution to massively scale the use of bitcoin for microtransactions globally, dramatically improving upon fees, as well as providing instant settlement times. The Lightning Network has experienced explosive growth and is expected to continue with the trend as usage increases. Well-known companies, such as Twitter and Square, have expressed their enthusiasm to incorporate Lightning Network into their platforms. The Lightning Network is scalable, global, open, inclusive, permissionless and decentralized. It is made up of nodes connected via payment channels, and enables off-chain, instantaneous and cheap payments at scale.

Upon launch of LQwD’s Lightning Network platform-as-a-service, users will be able to leverage the Lightning Network infrastructure to send payments instantly, securely and inexpensively anywhere in the world. Companies and service providers will be able to conduct Lightning Network transactions in bitcoin by integrating LQwD’s infrastructure with their business or web property. Connected businesses will be able to easily deploy, monitor and manage LQwD’s Lightning Network nodes with no or low-level technical knowledge required. The company fully expects Lightning Network to be a force for global change and to become the monetary exchange network of the future.

The Lightning Network, which is already built, functioning and growing, will advance bitcoin from a store-of-value to a global monetary network through payment utility. The company expects the Lightning Network will propel the growing number of active blockchain wallets to new heights, by increasing bitcoin’s scalability and lowering its fees for users. For coming generations, everything from wealth to experiences will be acquired and transacted virtually, and LQwD sees the Lightning Network as an enabling technology that can bring bitcoin to hundreds of millions of new users across the globe.

Market Outlook

Forbes in August 2021 noted that “private investors are funding companies that are building the infrastructure that will support future growth of crypto and digital assets,” and called public companies building cryptocurrency infrastructure “the hottest part of the crypto market.” While the first wave of investor interest in crypto firms was directed at companies catering to retail investors, investors have now shifted their attention to infrastructure builders, like LQwD FinTech. Forbes did not put an estimated value on the crypto infrastructure market but pointed out that large-scale adoption of cryptocurrencies will only happen when infrastructure is in place to support it. The larger digital payments market, of which crypto payments are a small fraction, is growing at more than 14 percent annually and is forecast to hit $154 billion by 2025.

Management Team

Shone Anstey is co-founder, chairman and CEO at LQwD FinTech. He has 20 years of experience in building complex technologies and has acted as technology lead for an industrial bitcoin mine and bitcoin mining pool. He is a Certified Cryptocurrency Investigator, and an advisor to the British Columbia Securities Commission. He is also co-founder of BIGG Digital Assets (OTCQX: BBKCF) and took that company public in 2017.

Barry MacNeil is CFO at LQwD FinTech. He is a member of the Chartered Professional Accountants of British Columbia and has more than 30 years of management and accounting experience with public companies and in private practice. His previous positions include director of both public companies and nonprofits, as well as Chief Financial Officer and Corporate Controller.

Albert Szmigielski is co-founder and CTO at LQwD FinTech. He was formerly the Head of Research and Chief Blockchain Engineer at Blockchain Intelligence Group and VP Research at CipherTrace. He holds a B.Sc. in Computing Science from Simon Fraser University, and a Master of Science in Digital Currencies and Blockchain Technologies from the University of Nicosia, Cyprus.

LQwD FinTech Corp. (LQWDF), closed Tuesday’s trading session at $0.106055, up 13.2401%, on 128,350 volume. The average volume for the last 3 months is 128,350 and the stock's 52-week low/high is $0.0754/$0.8102.

Recent News

- LQwD FinTech Corp. (TSX.V: LQWD) (OTCQB: LQWDF) - Lightning Network Gains as More Transactions are Processed; LQwD FinTech Corp. (TSX.V: LQWD) (OTCQB: LQWDF) Among Companies with Substantial BTC Invested in Network

- NYC Mayor Thinks Blockchain Is Future for Title Deeds, Birth Certificates

- As Bitcoin Gains Acceptance Worldwide, Companies Like LQwD FinTech Corp. (TSX.V: LQWD) (OTCQB: LQWDF) Leverage Lightning Network to offer Faster Transactions and Lower Fees

EverGen Infrastructure Corp. (TSX.V: EVGN) (OTCQB: EVGIF)

The QualityStocks Daily Newsletter would like to spotlight EverGen Infrastructure Corp. (TSX.V: EVGN) (OTCQB: EVGIF).

EverGen (TSX.V: EVGN) (OTCQB: EVGIF), Canada’s renewable natural gas (“RNG”) infrastructure platform, will releases its 2022 first-quarter financial results after market close today, May 24, 2022. In addition, the company will host a Zoom conference call to discuss company financial results and corporate updates on Wednesday, May 25. The Zoom event will begin at 10 a.m. ET. EverGen CEO Chase Edgelow will lead the call. In addition, EverGen signed a definitive agreement to acquire 50% interest in a portfolio of RNG development projects, known as Project Radius and owned by Northeast Renewables LP. The acquisition gives EverGen entry into the Ontario market and has potential to triple the company’s RNG capacity, exceeding 1 million GJ annually; the deal also gives EverGen a presence in three of the four largest jurisdictions in Canada and positions the company as the leading RNG infrastructure platform in the country. “The acquisition of Project Radius provides a foothold in Ontario, a new and strategic jurisdiction in which EverGen can continue to participate in the consolidation and growth of the RNG industry in the near term, as well as benefit from project economics in line with or exceeding those we have seen with our initial projects,” said EverGen CEO Chase Edgelow in the press release. “Working alongside Northeast to advance the projects, EverGen will deliver on our platform expansion commitments with the potential to exceed 1,000,000 GJ of RNG production annually. Ontario has an abundant amount of excess organic feedstock, and as a leader in the RNG industry, EverGen can develop the sustainable infrastructure that contributes to carbon-negative energy production and the greening of the province.” To view the full call, visit https://ibn.fm/ijHAN. To view the full press releases, visit https://ibn.fm/hO6y3 and https://ibn.fm/LonqB

EverGen Infrastructure Corp. (TSX.V: EVGN) (OTCQB: EVGIF) is developing Canada’s Renewable Natural Gas Infrastructure Platform, starting on the west coast in British Columbia. The company is combating climate change and helping communities contribute to a sustainable future by acquiring, developing, building, owning and operating a portfolio of renewable natural gas (RNG), waste-to-energy, and related infrastructure projects.

While EverGen is currently focused on British Columbia, its continued growth is expected across other regions of North America. RNG is produced differently than conventional natural gas, without drilling wells. RNG is derived from biogas, which is captured from decomposing organic waste in landfills, food waste, agricultural waste matter and wastewater from treatment facilities. This waste feedstock is supplied to an anaerobic digester which contains bacteria that breaks down organic matter in the absence of oxygen. The resulting biogas is captured and cleaned to create carbon neutral or carbon negative RNG to be used by the existing North American gas pipeline grid. By capturing these emissions and transforming them into RNG, then combusting into CO2, the overall greenhouse gases (GHG) impact is materially less potent than allowing natural decomposition to release methane into the atmosphere. Liquid and solid digestate matter is a byproduct of the RNG production process and is used as fertilizer and in other applications.

EverGen operates three projects in British Columbia. The company was incorporated in 2020 and went public in 2021, with its common shares listed on the TSX Venture Exchange under ticker symbol ‘EVGN’. In February 2022, EverGen’s common shares began trading on the OTCQB Venture Market in the U.S. under ticker symbol ‘EVGIF’. The company is headquartered in Vancouver.

Portfolio Projects

Fraser Valley Biogas is one of three projects in EverGen’s portfolio. Located in Abbotsford, British Columbia, the facility has been digesting manure and off-farm organics since 2011 and was the first agricultural digester in Canada to produce RNG. The RNG generated through this project is part of a FortisBC program to supply renewable gas to homes, businesses and other customers. Fraser Valley Biogas also provides Abbotsford farms with renewable fertilizer via the digestate produced. EverGen acquired Fraser Valley Biogas early in 2021 and is currently enhancing and expanding the facility. These optimization projects resulted in record production during the month of September 2021, supporting the growing demand for RNG in British Columbia. Optimization activities contributed an additional 18% of RNG production for September and a 9% higher year-to-date production compared to the previous year. The facility produces approximately 80,000 gigajoules of RNG, enough to heat more than 1,000 homes for a year.

Net Zero Waste Abbotsford, a wholly owned EverGen subsidiary and portfolio project, is an existing composting and organic processing facility and RNG expansion project. The British Columbia Utilities Commission recently approved a 20-year offtake agreement between the facility and FortisBC, an electricity and gas utility. Under this agreement, FortisBC will purchase up to 173,000 gigajoules of RNG annually for injection into its natural gas system upon completion of an anaerobic digester project at Net Zero Waste Abbotsford. Once construction is complete, this project is expected to produce enough energy to meet the needs of more than 1,900 homes.

Sea to Sky Soils, a wholly owned EverGen subsidiary and portfolio project, is an existing composting and organic processing facility and potential future RNG expansion project which has been operating near Pemberton, British Columbia, on Lil’wat Nation land since 2012. The Lil’wat Nation is a key partner and supporter of the facility, which has employed a majority of its staff from the First Nation since inception. The Sea to Sky Soils facility processed approximately 160 percent of its forecast tonnage in the second half of 2021. In total, Sea to Sky Soils processed approximately 36,000 tons of organic waste in 2021. The facility is working with the Ministry of Environment to expand its operational capacity in 2022. EverGen has partnered with local municipalities – including Metro Vancouver and the municipality of Pemberton – for the delivery of additional organic waste to the facility. The facility is an important part of EverGen’s RNG infrastructure platform and serves as a source of valuable feedstock to support the company’s existing and future operations.

Market Outlook

A report from Global Market Insights states that the biogas market is projected to see significant growth over the next few years, driven by a shifting preference to utilize biogas to reduce emission levels from traditional fuels. Escalating RNG usage by gas utilities as a sustainable and low carbon alternative to supply heat and electricity in industries and buildings will further stimulate growth. RNG is increasingly deployed across the transport sector, especially for heavy vehicles and vessels, to abate GHG emissions.

Many North American gas utilities have set RNG targets of 5% to 15% of production by volume in 2030, compared to less than 1% by volume in 2020. FortisBC has a goal of including 15% RNG in its gas supply by 2030. EverGen believes this presents a potential C$16 billion+ opportunity for RNG producers.

Management Team

Chase Edgelow is co-founder and CEO at EverGen. He has over 15 years of specialized private investment, finance, and technical expertise in the energy and infrastructure sectors. His background is as a Facilities Engineer with Petro-Canada, independently managing energy infrastructure capital projects located in western Canada. He holds a Professional Engineer designation from the province of Alberta.

Mischa Zajtmann is co-founder and President at Evergen. He has 15 years of experience providing consulting and management for Canadian and American companies in the natural resources and energy space. He is a corporate securities lawyer who began his career at Blake, Cassels & Graydon LLP. His J.D. is from the University of Saskatchewan Law School. He’s a member of the British Columbia Bar.

Sean Mezei is COO at EverGen. He has 20 years of experience in the RNG industry, having served previously as the president of Greenlane Biogas and as a senior manager at QuestAir, and founder and president of Dekany Consulting. He was a co-chairman of the American Biogas Council’s RNG working group for six years. He has been a Registered Professional Engineer in the province of British Columbia since 1994.

Natasha Monk is CFO at EverGen. She is a CPA with 12 years accounting, financial reporting, and tax experience in public practice and industry. She is currently a partner at Affirm LLP, where she advises and consults to a wide variety of companies in multiple industries across public and private sectors. Prior to joining EverGen, she worked at KPMG. She graduated from the University of Calgary.

EverGen Infrastructure Corp. (OTCQB: EVGIF), closed Tuesday’s trading session at $2.15, even for the day, on volume. The average volume for the last 3 months is 10,000 and the stock's 52-week low/high is $2.12/$4.21.

Recent News

- EverGen Infrastructure Corp. (TSX.V: EVGN) (OTCQB: EVGIF) - InvestorNewsBreaks - EverGen Infrastructure Corp. (TSX.V: EVGN) (OTCQB: EVGIF) Schedules Conference Call to Discuss Q1 2022 Financial Results, Enters Acquisition Agreement

- EverGen Infrastructure Corp. (TSX.V: EVGN) (OTCQB: EVGIF) Appears Well Positioned as Surging Energy Crisis Calls for Urgent Action Towards Non-Fossil-Fuel Alternatives

- InvestorNewsBreaks - EverGen Infrastructure Corp. (TSX.V: EVGN) (OTCQB: EVGIF) Featured in Latest Episode of Bell2Bell Podcast

Nowigence Inc.

The QualityStocks Daily Newsletter would like to spotlight Nowigence Inc.

- Gartner predicts that SaaS spending will reach $140 billion this year

- SaaS spending is increasing a stunning 20% per year

- Nowigence’s flagship offering — Pluaris — makes it happen through this business model

A Gartner report has indicated that Software-as-a-Service (“SaaS”) spending is projected to increase 40% in the coming years, an impressive future especially considering that annual spend has already reached hundreds of billions (https://ibn.fm/Lr8gT). That forecast is good news for Nowigence, a savvy company that solves many of today’s information overload problems with a proprietary AI platform that is available through the SaaS business model.

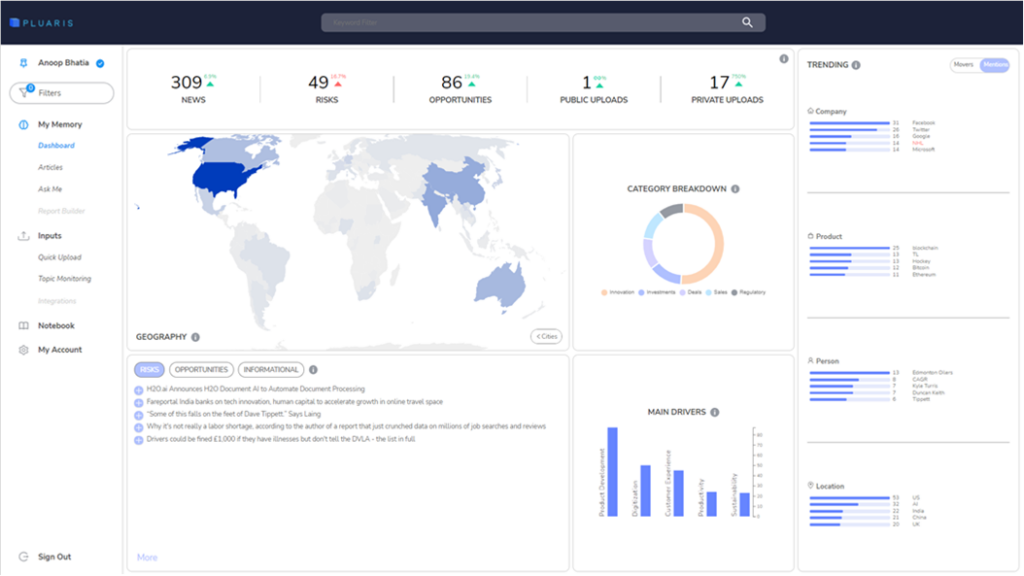

Nowigence Inc. is a fast-growing SaaS (Software-as-a-Service) company that develops and sells a ready-to-use artificial intelligence (AI) platform called Pluaris™ that automates reading and analysis of textual data. Individuals, teams, and enterprises can now quickly distill knowledge buried in narrative-intensive documents instantaneously from various data sources, both public and private.

Pluaris is created for those who want to read more in less time. It is a Personal Knowledge Management (PKM) tool that generates an annotated data feed based on your topics of interest and automatically creates a permanent personal knowledge base from your feed and private uploads. It has human-like capabilities for comprehending textual data. It summarizes, provides precise answers to questions asked, analyzes different data perspectives, discovers new connections, creates organized nested notes, and allows teams to work collaboratively by sharing in real-time from anywhere in the world to draw informed conclusions.

By integrating state-of-the-art data processing techniques in an intuitive interface at an affordable subscription price, Nowigence puts the power of data science in the hands of consumers. It helps individuals, teams, and organizations to quickly build expertise on one or multiple topics by generating a trove of critical information.

Nowigence targets two user types that rely heavily on fast and accurate research as primary adopters of the Pluaris platform. The first is knowledge workers of all kinds – anyone whose job is to “think for a living” like marketing professionals, researchers, legal professionals, academics, journalists, editors, scientists, and other professionals. The second are individual users who are life-long learners, hobbyists, and enthusiasts of all stripes.

Rather than spending time reading information to gain knowledge from one source at a time, users of Pluaris can gain knowledge from hundreds or thousands of sources in seconds. Keyword-based search-and-retrieval applications don’t open documents, nor read their content, nor extract key points, conduct cause and effect analysis or answer questions specifically. Pluaris includes all those features and goes one step further, with its semantic capabilities to empower users with interpretations of retrieved information. Nowigence estimates this feature alone can save typical researchers between one and three hours per workday. The platform also reduces “noise” by extracting only important and relevant information on every topic being monitored or researched. This helps cut down on information overload, a major source of workplace stress.

Pluaris Builds Intelligence

The Problem

In the modern world, virtually everyone needs to consume a tremendous amount of text-based information, in both our personal and professional lives, but doing so is exceptionally challenging because of:

- Information Overload: For virtually any significant topic of interest, the amount of textual information available and continually generated is vastly more than can be consumed by an individual.

- Pervasive Distractions: Thanks to modern technology, we are constantly bombarded with new inputs (e-mails, instant messages, social media, and more) reducing our attention span, leading all too often to TL;DR (Too Long, Didn’t Read).

- Highly Imperfect Human Recall: The information that we do find time to read is easily forgotten. Even if we retain some of the key insights, the details are almost certainly lost.

Even when working in teams, we often end up researching the same content as our colleagues, and too much of the information acquired by one individual is lost in translation with the communication process to others.

Pluaris

Nowigence has worked with stalwarts and pioneers in the fields of Machine Learning (ML) and Natural Language Processing (NLP) from its early days. The company was keen to solve the big problem of the information age – too much data exists and cannot be processed manually.

Pluaris is designed to be used by regular people from day one with no need for extensive training. The platform is used across different functions and sectors, adapting to clients’ ever-changing needs. Its state-of-the-art no code editing gives organizations the flexibility to improve and tailor their results without hiring data scientists, and real time information retrieval ensures the client never misses any piece of intelligence.

Pluaris adapts to the unique needs by which individuals absorb knowledge. It doesn’t impose structured or rigid methodology. Real time operation means that Pluaris will deliver outputs instantaneously with a click.

A Nowigence team of experts spent three years training Pluaris to understand the context of every sentence it reads. If Pluaris does make an error in contextual interpretation, the user can correct it, which will instantly give the correction precedence over the ML’s algorithmic outputs. This takes away the biggest criticism against AI/ML platforms, that annotating (labeling) data and developing training datasets to build models takes too much time and effort from internal teams.

Use Cases

I need to stay on top of the latest news for my industry. Pluaris automatically retrieves and analyzes news on your topics of interest every day, so you can quickly scroll through an annotated news feed on your phone, tablet or laptop, while finishing your morning coffee.

Example: A Pluaris enterprise customer was interested in tracking news and events in the telecom industry. Nowigence was able to quickly create and then fine-tune a list of topics to monitor. In less than a week, they had an annotated news feed covering the telecom industry available to their team.

I have to come up to speed on a new topic as quickly as possible. Upload a few related websites and documents to Pluaris and within minutes you are exploring this new area of interest, scanning the summaries, gaining new insights about this topic, and finding new keywords to broaden your search and deepen your understanding.

Example: A customer who was already using Pluaris for business intelligence decided to use his account to make improvements in his health after he received a report from his doctor of a high fasting blood sugar level.

- He uploaded a few research reports to Pluaris, read through the summaries, and explored the annotated labels. Based on that analysis, he set up Pluaris to monitor topics such as “lowering fasting blood sugar” and “low glycemic food.”

- From those results, he built an action list of daily habits for diet and fitness and, within a couple months, brought his fasting blood sugar level back down.

I want to be able to access the information I’ve read in the past and synthesize it with my current understanding. As you continue to add more and more information to the system over time, Pluaris never forgets. You are building a knowledge base of the information that is most relevant to you.

Example: A Pluaris user at one of the world’s largest aluminum mining companies was tasked with preparing talking points for her manager for an upcoming investor meeting. Over time using Pluaris, she had built a database of documents, including transcripts, notes, Q&A sessions, speeches, annual reports, and internal documents, some of which were from previous investor meetings. She was able to quickly explore that database through the Pluaris Dashboard and using various filters. She then pulled this information together in a Pluaris Notebook and shared that note directly with her boss.

Market Outlook

Pluaris users include:

- Knowledge Workers – Gartner estimates there are more than 1 billion worldwide as of December 2019.

- Students in Higher Education: ICEF estimates there are 250 million worldwide as of 2020. This is Nowigence’s initial target group from a market penetration perspective.

- Personal/Home Use: Statista estimates there are 4.7 billion active internet users worldwide as of January 2021.